unemployment tax refund 2021 calculator

Up to 10 cash back 2021 Tax Refund Calculator Estimate your federal tax refund for free today. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued.

Cerb Tax Calculator Cerb Tax Rate Kalfa Law

Unemployment pay1099-G retirement pay 1099-R.

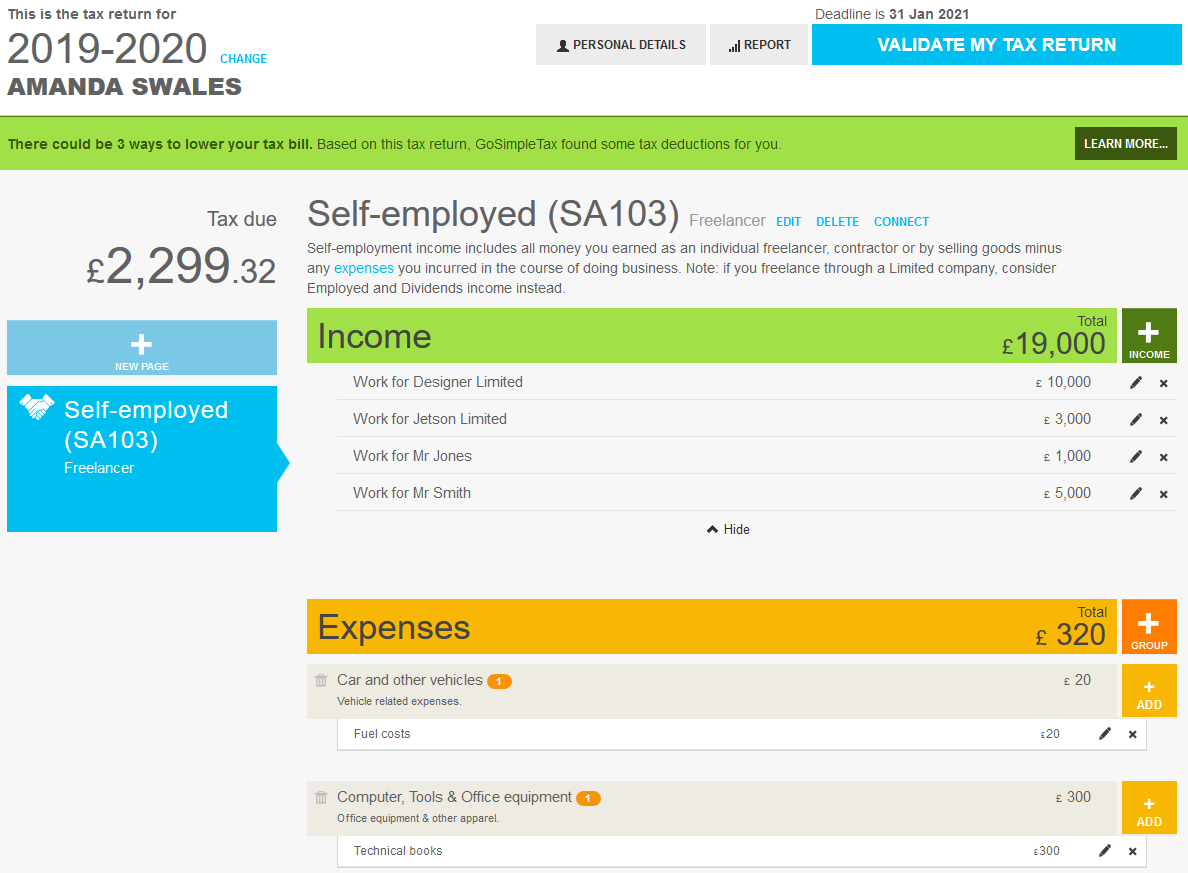

. Taking advantage of deductions. Estimate the areas of your tax return where needed. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. Deleted 1 yr. To check the status of an amended return call us at 518-457-5149.

The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021 along with meeting certain other criteria. I got my 2021 tax refund in like a week though lol. This way you can report the correct amounts received and avoid potential delays to.

When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Once an agreement is accepted the taxpayer must comply to the terms. You must file Schedule 1 with your Form 1040 or 1040-SR tax return.

This amount minus your deductions is used. It is mainly intended for residents of the US. As you make progress the taxes you owe or the refund you can expect to receive will be calculated and displayed on each page.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such. Our online Annual tax calculator will automatically.

The difference between the tax you owe and the tax you owed when originally filing should be your refund line 24 on you 1040. Heres what you need to know. Married couples who file jointly and where both spouses were unemployed in 2020 can.

This is only applicable only if the two of you made at least 10200 off of unemployment checks. It excludes up to 10200 of unemployment compensation payments from gross income if the taxpayers modified adjusted gross income is less than 150000. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

Look at a federal tax table to see your amount of tax owed. Line 7 is clearly labeled Unemployment compensation 3 The total amount from the Additional. Based on the Information you entered on this 2021 Tax.

Basically you multiply the 10200 by 2 and then apply the rate. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible. Start a New 2021 Tax Return. Look at Schedule 1.

Answer each question by either clicking on the options shown or by entering dollar amounts or other values. View solution in original post. The gross amount of unemployment from your 1099-G will be on line 7.

COVID Tax Tip 2021-46 April 8 2021 However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation. Because unemployment benefits are not considered earned income receiving unemployment rather than wages or salary may reduce. There are a variety of other ways you can lower your tax liability such as.

Unemployment benefits count as taxable income the unemployment income federal tax exemption does not include unemployment income for 2021. These Tax Calculators will give you answers. Im still waiting for my 2020 unemployment refund.

If you recieved 10200 or more in unemployed subtract 10200 from your taxable income line 15. If you didnt have tax withheld from their unemployment payments or didnt have enough withheld in 2021 you may owe money to the IRS or get a smaller-than-expected tax refund. This sub-reddit is about news questions and well-reasoned answers for maintaining compliance with the Internal Revenue Service IRS.

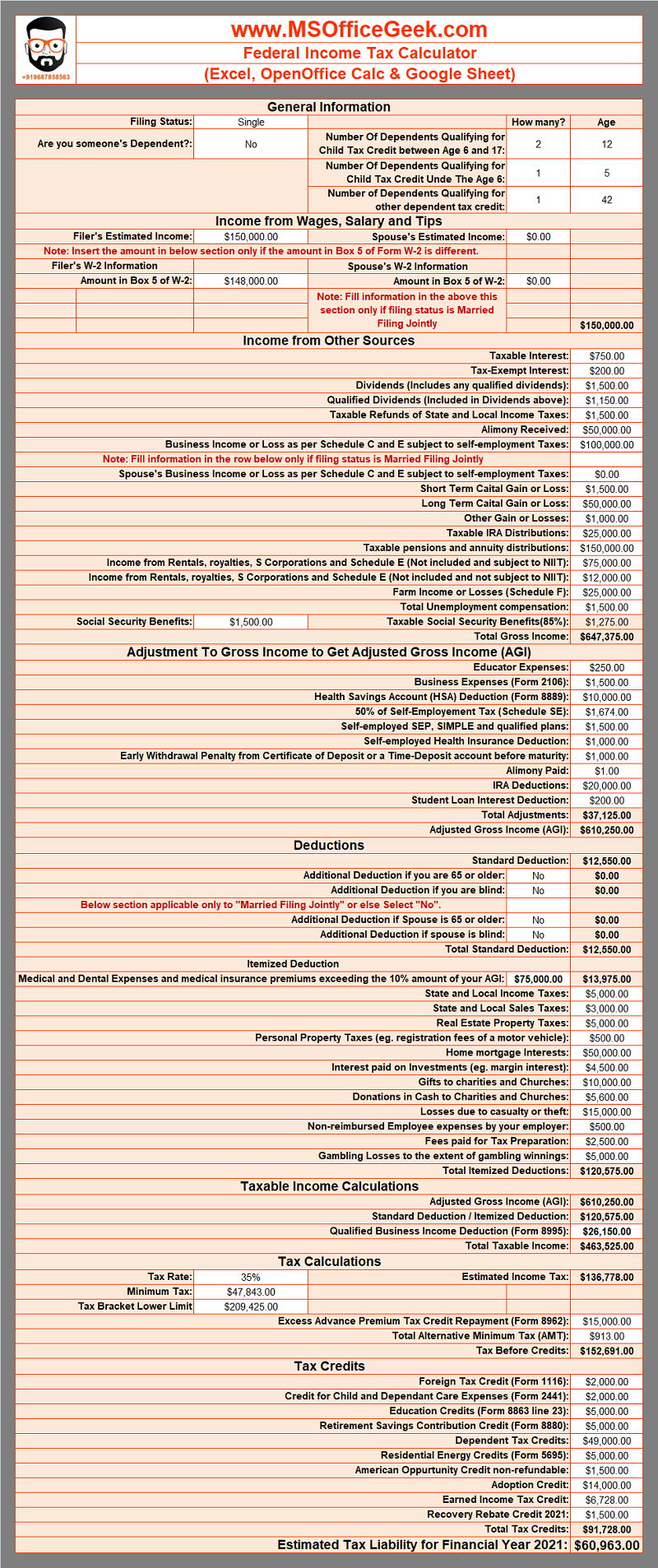

This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022. The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. An installment agreement is an agreement between the IRS and a taxpayer to allow the taxpayer to pay taxes owed in monthly payments.

IR-2021-212 November 1 2021. Another way is to check your tax transcript if you have an online account with the IRS. This handy online tax refund calculator provides a.

Enter your tax information to the best of your knowledge. Restart This Tax Return Calculator will calculate and estimate your 2022 Tax Return. Originally started by John Dundon an Enrolled Agent who represents people.

The deduction up to 10200 will be on line 8 with the notation UEC. Use any of these 10 easy to use Tax Preparation Calculator Tools. Usually the IRS will use its financial guidelines for determining how much a taxpayer can pay.

And is based on the tax brackets of 2021 and 2022. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. However paying taxes on unemployment income and understanding how getting unemployment affects your tax return calls for a bit more explanation especially if you want to avoid unpleasant surprises at tax time.

Youre eligible for the tax refund if your household earned less than 150000 regardless of filing status. This tax break was applicable. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Otherwise it will result. Yes No Self-Employment Form 1099-NEC or 1099-MISC. 4 days ago.

The American Rescue Plan Act of 2021 offered relief to people who received unemployment compensation in 2020 at the height of the pandemic when companies were laying off millions of workers. January 26 2022 158 PM. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. By far one of the most devastating economic impacts of the coronavirus crisis is. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison.

You will enter wages withholdings unemployment income Social Security benefits interest dividends and more in the income section so we can determine your 2021 tax bracket and calculate your adjusted gross income AGI. In short yes unemployment income is taxed. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Refund Calculator Shop 52 Off Www Propellermadrid Com

Tax Return Estimator 2020 Clearance 59 Off Www Propellermadrid Com

H R Block Tax Calculator Services

What Is Alternative Minimum Tax What Is Alternative Alternative Tax

Income Tax Calculator With Interest Shop 58 Off Www Norfarchtrust Org Uk

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

German Wage Tax Calculator Expat Tax

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Refund Calculator Shop 52 Off Www Propellermadrid Com

Refund Calculator Shop 52 Off Www Propellermadrid Com

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensatio Internal Revenue Service Tax Refund Topics

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Tax Return Calculator 2020 Deals 55 Off Www Propellermadrid Com

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Easiest 2021 Fica Tax Calculator

Refund Calculator Shop 52 Off Www Propellermadrid Com

Tax Calculator 2022 How To Compute Estimated Taxes For Freelances Sole Business Owner Itech Post

Tax Return Calculator 2020 Deals 55 Off Www Propellermadrid Com